A version of this article originally published in the Journal of the American Pharmacists Association

Co-authors:

- Kenneth C. Hohmeier, PharmD, Associate Professor, Director of Community Affairs, University of Tennessee Health Science Center, College of Pharmacy, Nashville, TN

- Cortney Storey, BS, Student, University of Tennessee Health Science Center, College of Pharmacy, Nashville, TN

- Nick Martin, BS, Student, University of Tennessee Health Science Center, College of Pharmacy, Nashville, TN

- Justin D. Gatwood, PhD, MPH, Associate Professor, University of Tennessee Health Science Center, College of Pharmacy, Nashville, TN

Send download link to:

Key Takeaways:

Background

- Existing payment models for community pharmacies are based on prescription drug sales, a form of fee-for-service reimbursement.

- Fee for service reimbursement may not sufficiently incentivize the implementation or expansion of pharmacist-based care for community pharmacies.

Findings

- The Membership Pharmacy Model may represent a viable alternative to fee-for-service reimbursement by generating pharmacy revenue through membership fees, not prescription drug sales.

- Future research on the Membership Pharmacy Model should determine the downstream impact on hospitalizations and overall health care spending.

Abstract

Background

There is a need to shift pharmacy payment models, given the expanding role of the community pharmacist in improving patient outcomes; mis-aligned incentives of the existing reimbursement model; and deleterious effects of a lack of transparency on prescription costs.

Objectives

- Primary: Develop a payment strategy for a Membership Pharmacy Model within an independent community pharmacy setting

- Secondary: Explore the early impact of a novel value-based pharmacy payment model on patients, pharmacies and self-insured employers.

Practice description

Good Shepherd Pharmacy is a nonprofit Membership Pharmacy founded in Memphis, Tennessee, in 2015. It now focuses on its original charitable purpose, while its sister company, HaloScrips, serves self-funded plans as described in this paper.

Practice innovation

We discuss a novel, value-based payment model for community pharmacy, which involves a partnership between pharmacy and employer without the use of a pharmacy benefit manager, instead using a recurring (membership pharmacy) revenue model.

Evaluation methods

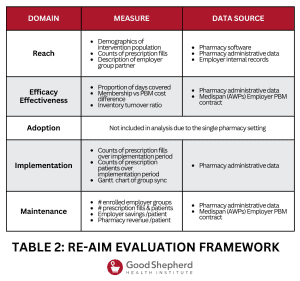

The pilot program was assessed using the RE-AIM framework.

Results

The pilot enrolled 34 patients for whom 1,399 prescriptions were filled over 13 quarterly refill cycles from January 2019 through March 2022. After the intervention:

- The proportion of days covered for diabetes and cholesterol medications both increased: 96.7% and 100% (P<0.05); 90.3% and 98.1% (P>0.05).

- Financial savings for the employer group were realized across both fee charges and prescription medication costs.

- The net savings provided to the employer was $67,843, a 35% reduction in topline pharmacy spending.

- Revenue for the pharmacy was realized exclusively through synchronization fees of $30 per fill.

-

- Synchronization fees for the entire study totaled $41,970, and the average revenue per quarterly batch refill was $3,228.

-

Conclusion

The Membership Pharmacy Model represents a potentially viable alternative to traditional fee-for-service, buy-and-bill pharmacy payment models through its use of medication pricing based on actual acquisition costs, lean pharmacy operations and value-based reimbursement methods.

Background

Community pharmacies continue to be recognized as an underutilized health care destination offering highly accessible and convenient services. Currently, community pharmacy settings are financed under a “buy-and-bill” fee-for-service model, in which pharmacies purchase medications through a wholesaler and fill them for patients on-demand.

Although this model represents the primary means for community pharmacy revenue, ancillary service offerings have grown in recent decades to support the medication use process and further diversify revenue sources. These include immunization programs, medication therapy management (MTM) services and more. These other offerings positively affect a variety of outcomes. In particular, medication synchronization programs have had a substantial positive impact on medication adherence. However, despite the overall positive impact on patient care, the existing “buy-and-bill” fee-for-service model incentivizes pharmacies to prioritize medication dispensing over patient care service implementation, rather than to offer these services in complement to each other. In addition to incentivizing prescription fills over patient care service, the long-term viability of this pharmacy payment model is uncertain. Gross profit per prescription has remained flat over the past decade, leading many pharmacies to fill more prescriptions with fewer staff.

Existing fee-for-service payment models are primarily administered through a pharmacy benefits manager (PBM). In 2018, the U.S. PBM market size was valued at $368.3 billion, with expectations to expand at a compounded annual growth rate of 9.2% through 2026. The top 3 PBMs (Express Scripts, CVS health. and OptumRx) manage pharmacy benefits for approximately 80% of the industry. Although PBMs originally existed as a means for cost containment and managed care for their sponsors, several professional organizations have expressed skepticism of the model’s current value within health care. Many current standard PBM practices have come under scrutiny in recent years, including the use of rebating and its link to increased prescription drug spending and medication costs.

Objective

- Primary: Develop a payment strategy for a Membership Pharmacy Model within an independent community pharmacy setting

- Secondary: Explore the early impact of a novel value-based pharmacy payment model on patients, pharmacies and self-insured employers.

Practice Description

Good Shepherd Pharmacy (GSP) is a nonprofit community pharmacy founded in Memphis, Tennessee, in 2015. Instead of contracting with PBMs to sell prescriptions for average wholesale price (AWP) minus a discount, the closed-door pharmacy charges a monthly membership fee and sells prescriptions at their actual acquisition cost (AAC). The pharmacy primarily serves low-income (<200% FPL) and uninsured patients with multiple chronic medications and fills an average of 50,000 prescriptions per year.

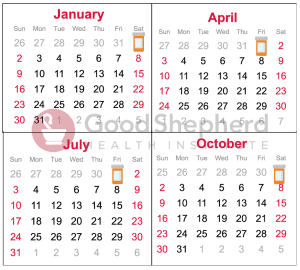

In October 2017, GSP initiated a group synchronization model for more than 900 patients. More than 4,200 chronic prescriptions were synchronized to be refilled on the same day every three months. This process has been maintained to the present time and has continued to evolve using principles of continuous quality improvement.

In September 2018, in an effort to test the feasibility of the existing membership model beyond low-income and uninsured patients, GSP partnered with Barnhart Crane and Rigging (BCR), a local self-insured employer, to investigate providing group synchronization as a novel population health management service. The goal was to develop a payment model that generated substantial savings for the employer, sustainable revenues for the pharmacy, and improved health outcomes for patients.

Practice Innovation

This novel, value-based payment model for community pharmacy involves a business-to-business partnership between pharmacy and employer group, without the use of a PBM. The model instead uses a recurring (Membership Pharmacy) business revenue model. A pilot program was used to develop a payment strategy and evaluate initial outcomes.

The Membership Pharmacy Model comprised three elements:

- Prescription price transparency: All medications are sold at actual acquisition cost (AAC)

- Lean pharmacy operations: Group synchronization to reduce dispensing costs and free up pharmacists’ time for clinical care

- Value-based payment: Incentives to reward improved outcomes, including shared savings and bonuses, while removing incentives that encourage more frequent prescription fills, such as dispensing or admin fees

In this model, the employer immediately realizes hard dollar prescription cost savings when the pharmacy passes along its true cost of the drug product (as compared with the price paid through a PBM contract). All prescriptions are sold at AAC with no markups or fees.

With no revenue generated by a prescription sale, this structure redirects the pharmacy incentive model from volume-based to value-based. Pharmacy services are instead funded through a membership fee paid by the employer. In addition, a shared savings bonus is paid to the pharmacy by the employer based on a pre-determined value-based payment structure, whereby the more medical and pharmacy spending is reduced by the pharmacy, the larger the bonus payment paid by the employer to the pharmacy.

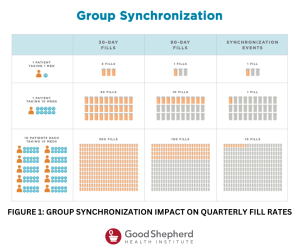

Secondary to the altered payment are the operational changes to the pharmacy workflow to focus pharmacists’ time on MTM service provision, chronic care management, and medication synchronization. Each member-patient’s prescriptions for the employer group were synchronized to a single set schedule and filled en masse quarterly for a 90-day supply (rather than individual synchronizations per patient). This was termed group synchronization.

Group synchronization occurs at the pharmacy just four times each year, which means staff can focus on just one aspect of the medication dispensing process over a period of time (rather than ever-changing varied types of workflow stations). Dedicated staff only perform those duties on those days across all patients enrolled in the model. This creates operational efficiencies in medication dispensing by eliminating waste inherent to traditional pharmacy workflows. Batch-filled medications include only chronic medications and exclude controlled substances and acute medications deemed urgent by the patient. The entire pharmacy operates within a fixed 12-week cycle that is continually improved.

In addition to a streamlined medication distribution process that reduces pharmacy cost per medication filled, the workflow design also generates additional time needed to provide other clinical pharmacy services like MTM, comprehensive medication management and MedSync. The pharmacy also uses the Optimizing Care Model, which includes the use of technician product verification to free up pharmacists’ time to provide clinical care services.

Evaluation Methods

The pilot program was assessed using the RE-AIM framework. This evidence-based program evaluation framework has been used in more than 700 peer-reviewed publications, including being specifically used in the planning, implementation and evaluation of programs to improve their chances of working in “real world” settings.

Given that only one pharmacy adopted this model and that the description of the pharmacy is found elsewhere in this paper, only reach, effectiveness, implementation and maintenance are reported in the results section.

Adherence

For select patients in the program, medication adherence was assessed using the proportion of days covered (PDC) metric, comparing adherence measurements before and after program implementation. Due to the nature of the program, patients had variable baseline and follow-up times; therefore, data in the pre- and post-implementation period used to calculate adherence were applied based on availability but for not more than 365 days in either the baseline or follow-up period. Consequently, the numerator was a sum of the days covered in either period, and the denominator was no less than 30 days and no more than 365 days.

Days’ supply ended on the date of program initiation (index date), with credit being added to the post-implementation period for fills whose supply would have been applied after the program began. Therefore, days’ supply in the post-implementation period would similarly not have been given credit for fills before the program began; therefore, counts of days’ supply began with the first fill in the post-implementation period.

Analyses focused on highly prevalent, chronic conditions for which non-adherence is a concern: Type 2 diabetes, hypertension, and hyperlipidemia. For patients with diabetes, only oral medications were considered in the calculations. For each condition, a patient with a PDC of at least 80% was deemed adherent. PDC and proportion adherent were presented for all conditions, and changes in adherence were assessed by Wilcoxon signed-rank tests.

Economic Analysis

Economic measures were used to assess the program’s impact on both the employer group and the pharmacy business model and included transaction fees, synchronization fees, AAC and AWP, along with the employer group’s existing PBM contracted rates minus AAC and synchronization fee charged by the program.

All savings were reported as net savings. The contracted rates were AWP minus 20% for brand drugs and AWP minus 80% for generic drugs. Medispan was used as the source for AWP calculations, and AWPs used in calculations were current to the quarter being compared with program charges.

The PBM contract included a transaction fee of $8 per fill and an average dispensing fee of $1.

Results

Primary Objective: Development of Membership Pharmacy Model payment strategy

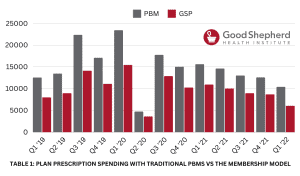

Financial savings for the employer group were realized across both fee charges and prescription medication costs (Table 1).

- Financial savings for the patient were in the elimination of prescription co-pays (no out-of-pocket costs).

- Regarding employer savings, the existing PBM contract for the employer included a transaction fee charge of $8 per prescription fill and a dispensing fee of $1 per prescription fill. Therefore, the shift from a 30-day fill to a 90-day fill saved $27 in fees per prescription per quarter.

- PBM medication charges were, on average, 82.7% higher than the Membership Pharmacy Model prescription charges.

- Price variability across patients and time posed by multiple generic manufacturers of the same drug or dose was also reduced because of synchronization. Synchronizing allowed for the purchase of the lowest-priced prescription drug from the wholesaler for each patient on the same drug in the company, which also contributed to overall prescription cost savings.

- The overall contracted PBM price for all medications was $159,095 versus the AAC of $87,056 used in the Membership Pharmacy Model. The difference in AAC and PBM price generated a gross savings of $72,032.

- Regarding contracted PBM fees, the elimination of these fees in the Membership Pharmacy Model totaled $33,576.

In the development of the payment strategy, a synchronization fee was initially agreed on between the pharmacy and the employer to cover initial estimated costs incurred by the pharmacy associated with the Membership Pharmacy Model. This was a temporary measure, as true cost savings from the model were unknown, and the fees were to be removed once the value-based payment strategy (shared savings on prescription costs) was established. These temporary fees totaled $41,970 by the conclusion of the pilot.

At the conclusion of the pilot, the net savings provided to the employer were $67,843 based on a 35% reduction in topline pharmacy spending. On average, the program generated $1,615 per patient in net savings, or about $194 per patient per quarter.

Secondary Objective

Results for the Membership Pharmacy Model pilot project reported using the RE-AIM framework can be found in Table 2.

Reach

Reach

The pilot enrolled 34 patients (Table 1) from a single Memphis-based employer group during the program implementation period, for whom 1,399 prescriptions were filled throughout the study period, which spanned 13 quarterly refill cycles from Jan. 1, 2019, through March 31, 2022.

Effectiveness

Prescription medication adherence was maintained in the Membership Pharmacy Model. Before the program, median PDC was 81.6% (oral anti-diabetics), 99.7% (anti-hypertensives) and 96.1% (lipid-lowering agents). During the same observation period, 4 of 5 patients with diabetes were adherent, all those with hypertension were adherent, and 10 of 12 patients on lipid-lowering agents similarly achieved a PDC of at least 80%.

Once the program began, mean and median PDCs for diabetes and cholesterol medications both increased: 96.7% and 100% (mean and median for anti-diabetics, P<0.05 [median change]); 90.3% and 98.1% (mean and median for lipid-lowering drugs, P=0.9740 [median change]).

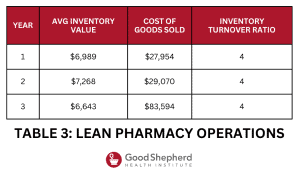

Table 3 describes measurement of lean pharmacy operations via the inventory turnover ratio. The Membership Pharmacy Model turned over inventory four times a year through its use of a just-in-time inventory process, which also served to improve the pharmacy’s cash flow by minimizing potentially unnecessary inventory. Inventory orders were only placed during four periods annually and followed the patient outreach phase of the model (Figure 1). Moreover, lean pharmacy operations improved over the study period, as synchronization rates improved and sustained at a rate >95%, meaning that at most 5% of prescriptions were filled between synchronization sessions.

Revenue for the pharmacy was realized exclusively through synchronization fees ($30 per fill). Synchronization fees for the entire study totaled $41,970, and the average revenue per quarterly batch fill was $3,228. On average, each patient generated $120 in pharmacy revenue per quarter or roughly $40 per patient per month.

Implementation

One of the goals of the pilot was to develop a model that could be scaled by other pharmacies nationwide. At the end of the pilot, the group synchronization method was a 12-week repeating operation cycle for the pharmacy that aimed to fill all prescriptions on the same refill schedule. Every process was recorded, assessed, formalized and re-assessed with each refill cycle.

The implementation period was from January 2019 through March 2022. Trends in patient enrollment and prescription fills can be found across each quarter in Table 3.

Maintenance

Pilot program long-term viability is dependent on employer savings and pharmacy revenue. Consequently, both per-member savings and per-member revenue were calculated over the course of the pilot.

Throughout the entire implementation period, net positive savings for the employer were realized, with all but one-quarter exceeding $100/patient/quarter (Table 1). Revenues per patient per quarter were, on average, $121 per quarter.

As of March 2022, nine employer groups had joined the Membership Pharmacy Model program, with seven actively enrolling patients. In addition to those patients enrolled in the current pilot program, the six additional employer groups represent 270 lives and 1,631 prescriptions. Along with the employer group described in this paper, long-term clinical and economic outcomes data are being collected for these nine additional employer groups to determine overall impact on health care spending and patient care, including both prescription drug spending costs and overall medical costs (including hospitalizations and emergency department visits).

During the pilot, a temporary $30 dispensing fee was used initially to 1) generate revenue to cover costs for the pilot, 2) determine economic viability, and 3) determine the ultimate Membership Pharmacy Model payment strategy. Total savings and savings net of the $30 dispensing fee can be found in Table 1, along with employer savings per member and pharmacy revenue per member. Based on this information, the pharmacy arrived at a $150/member/quarter membership fee based on pilot data for these added employer groups.

Practice Implications

The overarching aim of the Membership Pharmacy Model was to integrate both the dispensing and clinical functions of the community pharmacist through a new reimbursement structure that is not tied to the drug product (instead tied to a membership fee) and the use of a lean pharmacy operations model that features group synchronization. Initial clinical, operational and economic outcomes signal that the innovative joint pharmacy payment-operations model is both feasible and economically viable.

It is also important to note recent attention on lowering prescription drug prices by eliminating prescription markup. Namely, both Amazon Pharmacy and Mark Cuban’s Cost Plus Drug Company have implemented novel pharmacy business models that eliminate the PBM to reduce prescription prices. However, despite these other, similar models, the Membership Pharmacy Model presented here differs substantially in its potential for scalability, given its potential for more rapid scaling through the use of employer-group contracting and adjustments to improve pharmacy operational efficiencies (i.e. group synchronization).

Importantly, our model includes the provision of MTM, CCM and medication synchronization services to improve patient outcomes and reduce health care costs – something that has not been previously included in these other models.

A key driver of the Membership Pharmacy Model was the use of group synchronization to drive operational efficiency and improve patient outcomes. A robust body of evidence supports the idea that pharmacists can significantly improve adherence to prescribed medications.

Complex medication regimens – owing to the presence of concomitant chronic disease states – are a major cause of non-adherence for many patients. The Centers for Disease Control and Prevention suggests that 40% of adults 65 years or older are taking at least 5 medications, leading to an increased tablet burden for these patients. To overcome adherence barriers, community pharmacies have increasingly implemented medication synchronization programs that adjust patients’ medication refill dates to coordinate each patients’ prescriptions to be filled on the same day each month.

Importantly, a recent study demonstrated an improvement in mean adherence (~7%) for patients enrolled in the appointment-based medication synchronization program, as compared with the control group, whose adherence ranged from 58% to 63%.

Shifting the pharmacy business model from dispensing to membership changes the underlying incentive model such that the ultimate goal of the pharmacy becomes the good of the patient. The dispensing model generates a pharmacy that is incentivized to fill ever more prescriptions at ever higher prices. The downstream effects have made prescriptions more expensive, reduced access to medication and increased prescription waste. The membership model fundamentally aligns the business incentives of the pharmacy with the desired outcomes of the patient and creates a pharmacy that is incentivized to create happier, healthier patients. The downstream effects of the membership model improve medication access, decrease prescription prices, and improve outcomes.

There were study limitations. Only 1 employer organization was used in study recruitment, and the pilot lacked a control group, which may lead to selection bias. Future research should investigate the Membership Pharmacy Model across multiple employer groups and include a non-equivalent control from which to investigate difference-in-differences.

However, a strength of this study was the use of repeated measures, similar to an interrupted time series design, which allowed for reporting of trends over time and reduced the impact of secular bias. Moreover, downstream impacts of the Membership Pharmacy Model on overall employer health care spending and clinical outcomes must be evaluated to fully understand its value, as present outcomes such as PDC do not necessarily correlate with improved patient outcomes.

Given the short time duration of the present study, we were unable to identify downstream impacts on hospitalizations, emergency department visits, and overall health care spending. Future research on this model should investigate these outcomes, as they may be included in value-based payment agreements and provide further insights into the overall clinical impact of the model.

Finally, gross profit per prescription was calculated in the present study rather than net profit to more cleanly describe the financial impact of the model. However, net profit is the more universally accepted model of measuring pharmacy business success, given its incorporation of other variables, including software fees and insurance, among other things.

Conclusion

The Membership Pharmacy Model represents a potentially viable alternative to traditional fee-for-service, buy-and-bill pharmacy payment models through its use of medication pricing based on AAC, lean pharmacy operations, and value- based payment methods.